Restaurant Labor Cost Percentage: Today's Key Metric

- Erin Watkins

- Aug 29, 2023

- 8 min read

Learn to calculate restaurant labor cost percentages, grasp key expense factors, and discover strategies for optimal cost management.

Labor Optimization Revenue Optimization

In an era where every dollar counts, gauging your restaurant's financial well-being is vital. With the culinary landscape wrestling a tightening labor market and rising cost of goods sold, attention has sharply focused on two paramount metrics: the labor cost percentage and its relation to the higher labor cost as a percentage of total sales. Amid soaring food prices and prevailing staff shortages, overlooking this fundamental number could spell disaster for your venture. The ideal range depends on the menu and extensiveness of service, making it even more crucial to comprehend. Journey with us as we dissect the complex fabric of labor costs, highlighting its augmented importance in these demanding times.

Restaurant Operating Expenses

Navigating the world of restaurant finance requires a keen understanding of the myriad expenses that come into play.

Fixed Costs vs. Variable Costs

At the heart of any restaurant’s financial structure lie these two contrasting expense types. How do they differ?

Fixed Costs

Rent: Regardless of how bustling your restaurant gets, the rent remains consistent, acting as a steady monthly or yearly expense.

Insurance: Another consistent outlay, insurance premiums are typically unaffected by the restaurant's operational volume. These costs, among others, represent a set amount you'll be parting with irrespective of your restaurant's highs and lows.

Variable Costs

Food Costs: Ever fluctuating based on market prices, customer preferences, and seasonality, this is the amount you invest in procuring ingredients for your menu.

Labor Costs: As your busiest nights attract more customers, you might require additional staff, leading to higher wages, or during quiet periods, the opposite could be true. Labor costs ebb and flow in response to the restaurant's operational demands, making them a variable expense.

Launching a restaurant comes with its own set of financial challenges. These startup costs—ranging from acquiring new equipment and making infrastructural upgrades to developing a compelling marketing strategy—lay the foundation for your venture. While they are primarily one-off expenses, understanding and managing them effectively can set the stage for long-term profitability.

In essence, while fixed costs provide a sense of financial predictability, variable costs challenge restaurateurs to be adaptive and forward-thinking. Balancing these costs is the key to ensuring a restaurant's fiscal well-being.

Restaurant Labor Costs

Labor costs are often a significant slice of the restaurant expense pie. But what truly constitutes these costs? Let's delve deeper into the intricacies of labor expenses in the restaurant business.

Labor costs include every expenditure a restaurant makes on its personnel, from the head chef's salary to the dishwasher's hourly wage. What exactly encompasses these costs?

Prime Cost and Its Significance

Relation to Profitability: The prime cost is a crucial metric, summing up both labor and food costs. A watchful eye on this figure can provide insights into a restaurant's financial health.

Efficiency Gauge: By keeping prime costs at an optimal level, restaurateurs can ensure they're operating efficiently, striking a balance between quality service and profitability.

Itemizing Labor Cost Components

Hourly & Salaried Wages:

Hourly Wages: Payments made to employees (like servers or line cooks) based on the number of hours they work.

Salaried Wages: Fixed amounts paid to staff (often managerial roles) regardless of the hours they clock in.

Other Crucial Labor Expenditures:

Bonuses: Additional incentives provided to employees for exemplary performance or meeting specific targets.

Overtime: Premium pay for employees working beyond their standard hours, often governed by labor laws.

Health Benefits: Investments in health insurance or medical benefits for the staff.

Additional Considerations: This can also encompass payroll taxes, sick and vacation days, and any other labor-related costs that may arise in the course of business.

A well-informed restaurateur is ever-conscious of these labor costs, making strategic decisions to ensure a fine balance between stellar service and maintaining a healthy bottom line. Knowing where every labor dollar goes is the first step toward efficient management and sustained profitability.

How to Calculate Labor Cost Percentage

Diving into the financial metrics of a restaurant is paramount for effective management. One of the crucial measures that restaurateurs should be adept at calculating is the restaurant's labor cost percentage. Here's a breakdown of how to determine labor as a percentage of sales:

Determining Labor as a Percentage of Sales

Step 1: Extracting the Annual Labor Cost

Gather all labor-related expenses incurred over the year. This includes salaries, hourly wages, bonuses, overtime, benefits, and any other pertinent labor costs.

Step 2: Pinpointing the Restaurant’s Revenue

Identify the restaurant's total revenue for the year. This figure should be the gross revenue, i.e., the sum earned before deductions, taxes, and other expenditures.

Step 3: Simple Mathematics

Divide: Start by dividing the annual labor cost by the annual revenue. If, for instance, the total labor costs amount to $250,000 and the annual revenue is $750,000, the result of the division would be 0.33.

Multiply: Take the obtained figure and multiply it by 100 to get the percentage. Using the previous example, 0.33 multiplied by 100 equals 33%.

Result: Thus, in this hypothetical scenario, the labor cost as a percentage of sales would be 33%.

Understanding Labor in Relation to Total Operating Expenditures

Contrasting with the Sales-Oriented Approach:

While the sales-oriented method emphasizes direct relations between labor costs and sales revenue, this approach offers a broader perspective by considering labor costs in the context of total operating expenses. It reveals how a restaurant's labor costs stack up against all expenditures a restaurant incurs.

Sales vs. Total Operating Costs:

While sales provide a focused look at revenue, total operating costs include all expenses, like rent, marketing, utilities, and more, beyond just labor and food costs.

Calculating Labor as a Percentage of Total Operating Expenditures:

Calculate Restaurant Labor Costs Annually: As before, total all labor-related costs over a year.

Calculate Total Operating Costs: Aggregate all expenses incurred by the restaurant in a year – this encompasses everything from utilities to marketing campaigns.

Divide and Multiply: To determine the labor cost percentage in relation to overall operating costs, divide the labor cost by the total operating expenses and then multiply by 100.

Evaluating Labor Expenses Based on Staff Hours

Segmenting Staff Roles for Cost Analysis:

Different staff roles come with varied responsibilities, hours, and wages. To truly grasp the efficiency and distribution of labor costs, segmenting by roles offers a granular view.

For example, the wages for front-of-house staff might differ considerably from back-of-house employees like chefs and kitchen assistants.

Real-World Example: Kitchen Staff:

Scenario Setup: Consider a restaurant with five chefs, each working 40 hours per week at an average hourly wage of $20.

Calculation:

Determine Weekly Hours: 5 chefs x 40 hours each = 200 weekly hours.

Weekly Wages: 200 hours x $20 hourly wage = $4,000 weekly on chef salaries.

Annual Cost: $4,000 per week x 52 weeks = $208,000 yearly for chefs.

Interpretation: From this calculation, a restaurateur can deduce that a significant portion of their labor costs (in this example, $208,000 annually) is dedicated solely to kitchen staff. This insight helps when budgeting, scheduling, or considering operational changes.

By employing these methods, restaurant owners can gain a holistic understanding of their labor costs, ensuring they allocate resources effectively and maintain both profitability and high-quality service.

What’s the Ideal Restaurant Labor Cost Percentage?

Navigating the competitive landscape of the restaurant industry requires not just passion and delectable cuisine but also astute financial insight. One of the pivotal metrics that can make or break a restaurant's profitability is its labor cost percentage. So, what's the benchmark that restaurateurs should be aiming for?

Expert Recommendations

According to industry insiders and financial consultants, there's a general consensus on what constitutes a healthy labor cost percentage for restaurants.

The White-Hutchinson Leisure and Learning consulting group, among others, suggests that restaurant labor costs should ideally stay below 30% of the total revenue. This means if a restaurant makes $100,000 in sales, no more than $30,000 should go towards covering labor expenses.

However, combined with food costs, the total shouldn't exceed 60% of the revenue. This combined metric ensures that restaurants keep an eye on their two most significant variable costs, helping maintain a healthy bottom line.

Influence of Restaurant Type

Each type of restaurant model presents unique overheads, expectations, and, consequently, distinct labor cost percentages.

Fine Dining: Establishments that offer fine dining experiences generally have higher labor cost percentages. This can be attributed to the need for experienced chefs, sommeliers, and more extensive serving staff to deliver a premium service. The intricacies of gourmet dishes also mean longer prep and cooking times. Consequently, in fine dining restaurants, the average labor cost percentage can often exceed the typical 30% benchmark, occasionally touching 35-40%

Fast Casual: On the other hand, fast-casual eateries operate on efficiency and speed. These establishments often have a streamlined menu, faster turnaround times, and a more relaxed service structure (like counter service instead of table service). This model can often maintain labor costs at or even below the recommended 30%, sometimes achieving rates as low as 25%.

To wrap it up, while industry benchmarks offer valuable guidelines, it's essential for each restaurateur to consider their unique operational model, market positioning, and goals. Consistently monitoring and adjusting in response to the labor cost percentage can pave the way for sustainable success, irrespective of the dining experience they offer.

Smart Strategies to Optimize Restaurant Labor Costs

In the fast-paced world of the restaurant industry, every penny counts. Labor costs, as one of the most significant expenses for any restaurant, naturally come under scrutiny. But slashing these costs haphazardly can have detrimental effects, both on employee morale and service quality. Instead, the key lies in smart optimization. Here’s how to approach labor costs without compromising on service or staff well-being:

1. Avoid Indiscriminate Cost-Cutting:

Cutting costs without a strategic plan can lead to disgruntled staff, increased turnover, and a potential dip in service quality. Always prioritize the long-term health of your restaurant over short-term savings.

2. Embrace Technology for Accurate Clock-Ins:

Leveraging point-of-sale (POS) systems or dedicated clock-in tech ensures that employees are paid for the exact time they work, eliminating any discrepancies or potential time theft.

3. Incentives to Boost Attendance:

Consider introducing bonuses or rewards for consistent attendance. Not only can this reduce absenteeism, but it also fosters a more committed and motivated workforce.

4. State-by-State Overtime Navigation:

Labor laws vary from state to state, especially regarding overtime. Familiarize yourself with local regulations to ensure compliance and avoid unnecessary expenses.

5. Monitor Hours Regularly:

Keep a close eye on how many hours your staff works, especially those nearing overtime thresholds. This proactive approach can help you make timely adjustments and avoid surprise costs.

6. Upskill and Cross-Train Your Team:

A versatile team can adapt to various roles as needed. By cross-training staff members, you can ensure smooth operations even when facing unexpected staff shortages. For instance, a trained hostess could fill in for an absent server.

7. Advanced Scheduling Techniques:

Utilizing scheduling software can help plan shifts more efficiently, ensuring that you have the right number of staff members during peak times without overstaffing during slower periods.

8. Go Digital with Payroll:

Transitioning to a paperless payroll system not only reduces environmental impact but also streamlines the process, reducing errors and ensuring timely payments. Moreover, digital labor management tools can offer insights into labor costs, helping in further optimization.

9. Sales Forecasting Tools:

Predicting busy periods and potential lulls can be invaluable. With sales forecasting tools integrated into modern POS systems, restaurants can anticipate demand, allowing for more precise staff scheduling and cost-saving.

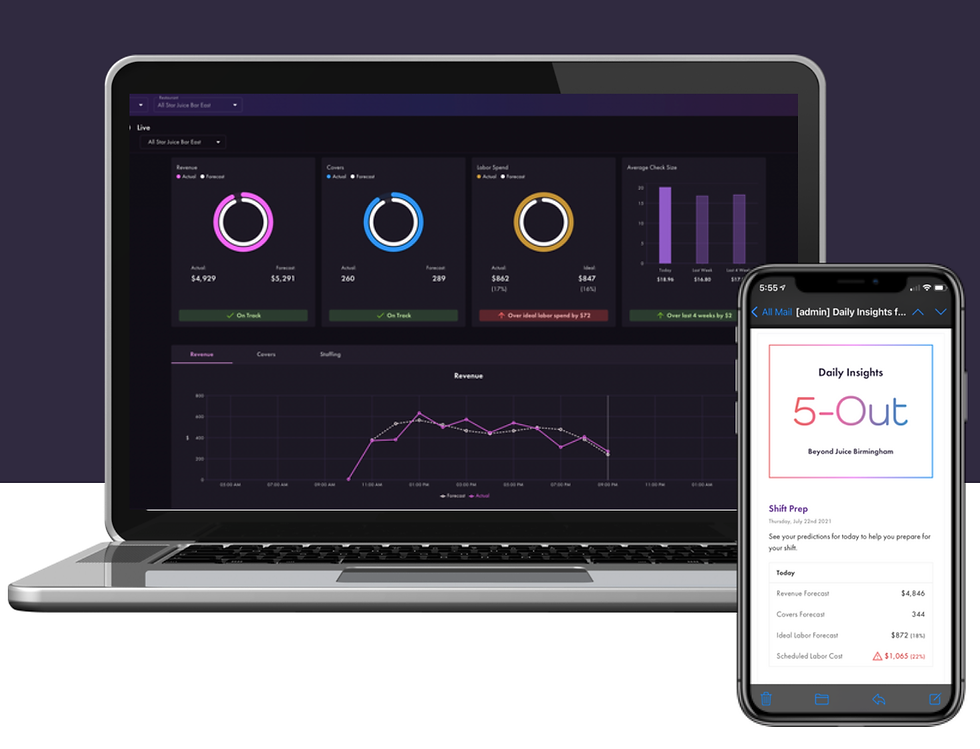

5-Out: Revolutionizing Restaurant Revenue Predictions

In the dynamic landscape of the restaurant industry, foresight can be your most valuable asset. Enter 5-Out: a cutting-edge sales forecasting software tailored for restaurants. Harnessing the power of machine learning, 5-Out doesn't just predict the future—it does so with unparalleled precision, ensuring your restaurant operates at peak efficiency and profitability.

Machine Learning: Utilizes advanced machine learning for sales predictions.

High Accuracy: Forecasts future sales with up to 98% confidence.

Labor Insights: Provides real-time data on labor scheduling for cost efficiency.

Integration: Seamless setup and integration with existing restaurant management systems.

Profit Maximization: Designed to reduce labor costs and drive higher profit margins.

Smart management of labor costs doesn't mean cutting corners. By investing in technology, training, and thoughtful strategies, restaurateurs can strike a balance that benefits both their bottom line and their valued employees. Experience the evolution of forecasting with 5-Out.

Ready to optimize your restaurant's efficiency and profitability? Request a demo of 5-Out today and elevate your management game!

Comments